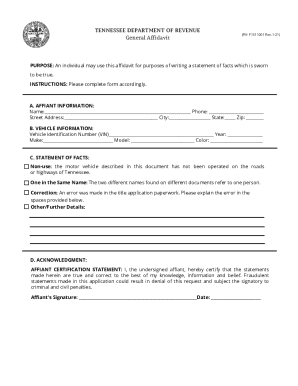

TN RV-F1311001 2012 free printable template

Show details

Print State of Tennessee Department of Revenue Vehicle Services Division Reset 44 Vantage Way, Suite 160 Nashville, Tennessee 37243-8050 AFFIDAVIT Comes the Affine (Printed Name) Under penalties of

pdfFiller is not affiliated with any government organization

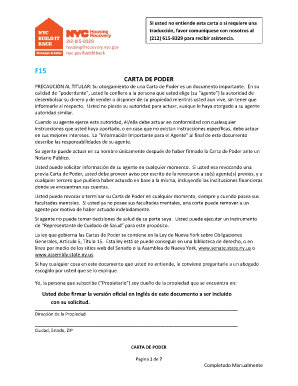

Get, Create, Make and Sign carta de sostenimiento ejemplo form

Edit your carta de sponsor para inmigracion form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ejemplo carta para inmigracion form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit carta de apoyo para inmigración en español online

Use the instructions below to start using our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit carta de sostenimiento económico ejemplo form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TN RV-F1311001 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out carta de affidavit para inmigracion form

How to fill out carta de sostenimiento ejemplo:

01

Begin by including your personal information at the top of the carta de sostenimiento ejemplo. This should include your full name, address, and contact information.

02

Next, mention the purpose of the carta de sostenimiento ejemplo. State that you are providing a support letter to demonstrate your financial ability to support yourself and/or someone else financially.

03

Provide information on your financial status. Include details such as your occupation, monthly income, and any additional sources of financial support. Make sure to include specific numbers and be as detailed as possible.

04

If you are supporting someone else, include their personal information as well. This should include their full name, relationship to you, and their current financial situation.

05

Highlight any specific expenses or financial responsibilities that you will be covering, such as housing, education, medical expenses, etc.

06

Close the letter by expressing your willingness and commitment to financially support the individual in question. Provide your signature and date the letter.

07

The carta de sostenimiento ejemplo is needed by individuals who need to demonstrate their financial ability and commitment to support themselves or someone else. This can include individuals applying for visas, sponsorship, or any situation that requires proof of financial support.

Fill

ejemplo carta de apoyo para inmigracion

: Try Risk Free

People Also Ask about ejemplos de affidavit para inmigracion

¿Cómo llenar la forma I 864 paso a paso 2022?

Para completar este formulario, debe tener disponible la siguiente información: Nombre y dirección del inmigrante principal. Nombres de los familiares del inmigrante principal y la relación con el inmigrante principal. El nombre de su empleador y su ingreso anual.

¿Cómo hacer una carta de sostenimiento?

Para poder firmar una Carta de Sostenimiento (Affidavit of Support), ud. necesita ser un Residente permanente o Ciudadano de los Estados Unidos, además debe presentar copias de sus declaraciones de impuestos de los tres últimos años, incluyendo las formas W-2 si ud es empleado de una compañía.

¿Cuál es el formulario I 134 en español?

I-134A, Solicitud en Línea para Convertirse en Persona de Apoyo y Declaración de Apoyo Financiero.

¿Cuál es la forma i864?

I-864, Declaración Jurada de Patrocinio Económico bajo la Sección 213A de la Ley. La mayoría de los inmigrantes con visa basada en la familia y algunos inmigrantes con visa basada en empleo usan este formulario para demostrar que cuentan con medios financieros adecuados y no es probable que dependan del gobierno de EE.

¿Cuál es la forma I-134?

I-134A, Solicitud en Línea para Convertirse en Persona de Apoyo y Declaración de Apoyo Financiero. AVISO: Solo aceptamos la presentación del Formulario I-134A por parte de personas que aceptan apoyar financieramente a un: Ucraniano o miembros de su familia inmediata como parte de Unión por Ucrania; o a un.

¿Cuánto cuesta el formulario I 134?

Formulario I-134 de USCISFormulario de Declaración Jurada de Apoyo. Paquete de solicitud $95 + tarifas de USCIS.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send cartas para inmigración ejemplos pdf to be eSigned by others?

When you're ready to share your como hacer una carta de affidavit para inmigración, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Where do I find carta de sostenimiento?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the carta de apoyo para inmigración. Open it immediately and start altering it with sophisticated capabilities.

How do I make changes in ejemplo de affidavit en espanol?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your modelo de carta para uscis to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

What is TN RV-F1311001?

TN RV-F1311001 is a form used by taxpayers in Tennessee to report and pay the state's tax on certain activities, such as the use of vehicles, equipment, or other property.

Who is required to file TN RV-F1311001?

Individuals or businesses that engage in activities that require the payment of specific taxes related to the ownership or use of vehicles or property in Tennessee are required to file TN RV-F1311001.

How to fill out TN RV-F1311001?

To fill out TN RV-F1311001, you need to provide details such as your personal information, the type of tax being reported, the taxable amount, and any deductions or credits, along with your signature and date.

What is the purpose of TN RV-F1311001?

The purpose of TN RV-F1311001 is to accurately report and remit taxes owed to the state of Tennessee for specific activities involving vehicles or property to ensure compliance with state tax regulations.

What information must be reported on TN RV-F1311001?

The information that must be reported includes taxpayer identification details, the nature of the tax being reported, taxable amounts, applicable deductions or credits, and any pertinent supporting information as instructed on the form.

Fill out your TN RV-F1311001 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Carta De Sostenimiento Económico Para Visa is not the form you're looking for?Search for another form here.

Keywords relevant to carta de soporte para inmigracion

Related to carta para inmigración ejemplos

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.